News

Cooperation to improve students’ financial and entrepreneurial knowledge

The Hungarian Banking Association is baffled by the planned increase in the so-called extra profit (windfall) tax, as the consequences of the severe overtaxation of the financial intermediary system to date are clearly reflected in Hungary's unfavourable economic indicators.

When the so-called extra profit tax was introduced in 2022, originally planned for two years, the Hungarian Banking Association already indicated that the measure would not only undermine the profitability of banks, but also significantly worsen the situation and prospects of the entire Hungarian economy. Since the measure was introduced, the benchmark interest rate has fallen from 18% to 6.5%, which means that the extra tax is no longer justified and should be abolished rather than increased. Domestic banks have repeatedly stated that the extra burden imposed on top of hundreds of billions of forints in traditional taxes deeply and negatively interferes with the market processes of the financial intermediary system, thereby not only undermining the sector's efficiency and international competitiveness, but also reducing investor confidence in the Hungarian economy.

The tax and regulatory systems applicable to banks and their frequent changes are a direct result of the unfavourable economic trends of recent years, including low levels of investment, persistently high inflation and lack of growth.

According to the budgetary plan, in 2025 Hungarian banks will pay HUF 842 billion into the state budget in the form of special taxes, windfall taxes and transaction fees, in addition to traditional taxes (Source: 2025 budget https://net.jogtar.hu/jogszabaly?docid=a2400090.tv), and this amount does not include the impact of the repeatedly extended interest rate cap, the ATM installation obligation and the planned significant increase in the free cash withdrawal limit, which will amount to tens of billions of HUF.

The Hungarian Banking Association emphasises that stimulating economic growth is in all stakeholders’ universal interest, which requires an increase in the loan portfolio, and this is why domestic banks are participating in the implementation of state-supported programmes.

11 November 2025

Hungarian Banking Association

Press Release: Increasing the extra burden on banks will affect the entire Hungarian economy, slowing down economic growth further and damaging the country's reputation

The Hungarian Banking Association is baffled by the planned increase in the so-called extra profit (windfall) tax, as the consequences of the severe overtaxation of the financial intermediary system to date are clearly reflected in Hungary's unfavourable economic indicators.

When the so-called extra profit tax was introduced in 2022, originally planned for two years, the Hungarian Banking Association already indicated that the measure would not only undermine the profitability of banks, but also significantly worsen the situation and prospects of the entire Hungarian economy. Since the measure was introduced, the benchmark interest rate has fallen from 18% to 6.5%, which means that the extra tax is no longer justified and should be abolished rather than increased. Domestic banks have repeatedly stated that the extra burden imposed on top of hundreds of billions of forints in traditional taxes deeply and negatively interferes with the market processes of the financial intermediary system, thereby not only undermining the sector's efficiency and international competitiveness, but also reducing investor confidence in the Hungarian economy.

The tax and regulatory systems applicable to banks and their frequent changes are a direct result of the unfavourable economic trends of recent years, including low levels of investment, persistently high inflation and lack of growth.

According to the budgetary plan, in 2025 Hungarian banks will pay HUF 842 billion into the state budget in the form of special taxes, windfall taxes and transaction fees, in addition to traditional taxes (Source: 2025 budget https://net.jogtar.hu/jogszabaly?docid=a2400090.tv), and this amount does not include the impact of the repeatedly extended interest rate cap, the ATM installation obligation and the planned significant increase in the free cash withdrawal limit, which will amount to tens of billions of HUF.

The Hungarian Banking Association emphasises that stimulating economic growth is in all stakeholders’ universal interest, which requires an increase in the loan portfolio, and this is why domestic banks are participating in the implementation of state-supported programmes.

11 November 2025

Hungarian Banking Association

The banking sector have helped save more than 4,000 lives

The sixth edition of the “JÓTETTBANK – Month of Bank Blood Donors” social campaign has come to an end, during which employees of the banking sector made nearly 1,400 blood donations, helping to save the lives of more than four thousand people.

Press Release: The Hungarian Banking Association opposes the increase of the free cash withdrawal limit

The Hungarian Banking Association firmly opposes the increase of the free ATM cash withdrawal limit, as it causes significantly more harm to society and the economy than the benefits it provides to the state.

Banking Sector Unites Again for Blood Donation Month

Budapest, 6 October 2025 – Once again, representatives of the Hungarian banking sector and the Hungarian Banking Association are rolling up their sleeves to draw attention to the importance of blood donation. This joint initiative – supported for several years by the Ministry of Agriculture and partnered by the Central Bank of Hungary – aims to encourage bank employees to participate in voluntary blood donations, contributing to the production of thousands of blood products that can heal and save lives.

Members of the Banking Association have submitted a petition to the Constitutional Court concerning the renewed extension of the household interest rate cap.

Several members of the Hungarian Banking Association have submitted a petition to the Constitutional Court, requesting a ruling that the repeated extension of the regulation known as the household interest rate cap is unconstitutional.

Announcement regarding an error caused by a domestic non-bank payment service provider and its management

On 6 August 2025, several domestic bank customers experienced a scenario whereby their previous bank card transactions had been incorrectly debited again to their payment accounts. The error was caused by a technical problem on the side of a card acquiring organisation outside the banking sector. In such cases, both card companies and banks are responsible for the technical processing of the transactions.

The banks immediately began investigating the transactions concerned and duly informing customers. Any incorrectly debited items have been re-credited.

Although the proportion of duplicate transactions is not significant relative to the total turnover of the banking sector, the Hungarian Banking Association is in regular consultation with the parties concerned, in particular with the National Bank of Hungary. The aim is to ensure that customers have access to secure and reliable financial services under all circumstances, and that similar errors can be avoided.

We thank our customers for their patience and understanding.

8 August 2025 Hungarian Banking Association

Hungarian Banking Association: We support the spread of Qualified Corporate Loans

In order to stimulate economic growth, the Hungarian Banking Association is calling on its Member Banks to consider participating in the Hungarian National Bank's Certified Corporate Loan Programme. In the current economic situation, it is essential that all planned and realistically feasible corporate investments are implemented on time, and that the banking sector is able to provide economic players with the required loans.

A predictable and stable financial and economic environment, the provision of the right conditions for organic market processes and the prosperity of the European economy together provide the basis for new investment decisions. The core task of a competitive banking sector is to be able to finance the credit needs of businesses in accordance with market principles, at favourable interest rates and on reasonable terms.

A key objective is for the domestic banking sector to support new investment decisions and their implementation through Qualified Corporate Loan Products for small and medium-sized enterprises, especially medium-sized companies and dynamically developing lower-medium sized businesses.

As the financial situation and the operations of businesses are best known to their own account-holding banks, the general market expectation is that these institutions should finance realistic investment needs supported by business plans on favourable terms, subject to appropriate risk assessment.

For the above reasons and in order to promote the development of the Hungarian economy, the Hungarian Banking Association encourages its Member Banks to consider joining the new loan scheme initiated by the National Bank of Hungary.

1 August 2025 Hungarian Banking Association

ESG Platform of the Banking Association

Only available in Hungarian

Call for Proposals for the Establishment and Operation of the ESG Platform of the Banking Association

Only available in Hungarian

Call for Proposals for the Establishment and Operation of the ESG Platform of the Banking Association

Only available in Hungarian

Statement

Several members of the Hungarian Banking Association have appealed to the Constitutional Court to rule that the regulation known as the retail interest rate cap is unconstitutional.

Statement of Secretary General

In response to questions posed by MTI regarding foreign currency loans, Levente Kovács, Secretary General of the Hungarian Banking Association, issued the following statement:

"The issue of foreign currency loans in Hungary was closed by the government, the MNB and the banking sector in 2015 through legislation, with settlement at a preferential exchange rate and conversion to forint.

The Court of Justice of the European Union examined the specific case of a non-bank financial service provider, and based on this, the interpretation of the judgment and the decision in the specific case will be the responsibility of the Hungarian court hearing the case.

According to expert opinions, the general information and contracts provided by banks and their subsidiaries are fair and valid.

(Translated with DeepL.com)

EBF Press Release

A competitiveness and growth regulatory mindset for Europe’s banks

16 May 2025, Warsaw – As global dynamics shi1, Europe must secure growth, prosperity, and safety. The EU needs an €800 billion annual investment gap and another €800 billion by 2030 for security and defense. The European Commission’s CompeFFveness Compass focuses on three prioriFes: boosFng innovaFon, acceleraFng decarbonisaFon and compeFFveness, and reducing strategic dependencies. Europe’s banks are crucial to this endeavour. By mobilising capital and offering innovaFve and secure soluFons to ciFzens and businesses, they can help meet the conFnent’s most urgent needs. A compeFFve Europe needs a compeFFve banking sector. At its meeFng on 16 May, the European Banking FederaFon (EBF) Board discussed the main prioriFes to unlock this potenFal.

EBF President Slawomir Krupa stated: “Bold and decisive ac/on is essen/al to rebuild Europe’s economic leadership and achieve results. Delivering real change in these areas demands a fundamental shi= in mindset—away from a too defensive posture, based upon the flawed assump/on that extreme resilience equals health and strength, towards a more proac/ve approach that embraces growth, appropriate risk-taking and investment as necessary ingredients for compe//veness, growth, and prosperity. Europe’s banking sector remains at the centre of the EU’s growth strategy and needs to be supported by a regulatory and supervisory framework that empowers it to finance Europe's vital needs: innova/on, energy, defence, security, sustainability and strategic autonomy.”

Unlocking capital for growth and security

To unleash growth potenFal, Europe needs to unlock bank capital as a fundamental resource for supporFng its economy and businesses. Now is the Fme to put that capital to work and ensure that the regulatory framework and supervisory practice move beyond a sole focus on extreme resilience, toward one that empowers the financial sector to act as a true catalyst for growth. Since 2008, the conFnuous efforts of the banks and EU’s financial regulatory architecture have ensured that European banks are resilient and well-capitalised. However, they are also subject to very high capital requirements and operate under the constant perspecFve of further increases, forcing overcauFousness, because the European banking system is weighed down by naFonal discreFons, capital add-ons and gold-plaFng over internaFonal standards. Taking into account the already proven resilience and without quesFoning the fundamental objecFve of financial stability, it is Fme to reassess the capital requirements faced by European banks and notably the mulFple layers of supervisory capital add-ons imposed at the EU level beyond the Basel minimum requirements. This assessment should also take into account internaFonal developments, where some major jurisdicFons may not fully implement the Basel III endgame. This raises a criFcal issue of compeFFveness for European banks, whose market share has already been declining compared to their U.S. counterparts, including in key areas such as wholesale and capital markets in Europe. It also presents the quesFon of how much capital is being unnecessarily locked out of the financial system — capital that could otherwise be more effecFvely used to support lending to households and businesses. For the same reason—unlocking capital—reviving the securiFsaFon market in Europe should be a key priority too, as it would increase banks’ lending capacity. It would also provide professional investors with a broader range of secure, diversified investment opportuniFes and access to risk management tools.

Europe’s banking sector: A strategic sector

As Europe shi1s from an over-focus on risk avoidance to an agenda of growth, it must recognise its banking sector as a strategic enabler. As proposed in the Savings and Investments Union (SIU), the EBF supports the development of a dedicated report to assess the compeFFveness of the European banking sector and guide future policy, as well as tangible measures to foster it, as soon as possible in 2026.

Simplifying & adjus3ng the regulatory and supervisory framework for growth

Banks’ ability to serve efficiently future needs faces a complex and fragmented supervisory and regulatory framework, with proliferaFon of rules, standards, guidelines, supervisory expectaFons (level 2 and level 3), and naFonal discreFons, in all areas of banking acFvity, including rules governing retail banking, digital finance, and cyber resilience. Between 2019 and 2024, the EU issued approximately 13,000 new regulaFons, and EU’s financial rulebook now exceeds 15,000 pages of direcFves and standards. It is therefore essenFal to examine what can be simplified and streamlined to enhance regulatory and supervisory efficiency going forward. Regulatory complexity is affecFng also Europe’s sustainable and digital transiFons, o1en coupled by insufficient analysis of costs, risks, and benefits, and inadequate consideraFon of unintended consequences that could disadvantage EU banks. The European Commission’s efforts to align regulaFon with both compeFFveness and sustainability objecFves are welcome and need to extend to digitalisaFon as well. The next step must be to reduce regulatory complexity and enhance the compeFFveness of Europe’s industry and banking system, fostering the financing of businesses and beaer servicing of consumers. The first omnibus is a welcome first step in the right direcFon and is fit for the current challenging and rapidly changing environment.

New ideas must pass the competitiveness test

A rigorous mindset should apply, even more urgently, to new proposals with the potenFal to heavily impact the financial services landscape. The legislaFve proposals for financial data sharing and digital euro, currently under review by the co-legislators, are cases in point. Regarding FiDA: despite acknowledging the innovaFon potenFal of cross-sectoral data sharing, banks have serious concerns about the proposal’s cost implicaFons, divergence of resources without proven market demand, broad scope and unrealisFc Fmelines, and unclear roles for non-EU actors. These should be addressed with robust provisions and a bold rethinking process: the ability of European banks to innovate and compete needs to be the filter for scruFny within a changed (geo)poliFcal context, and withdrawal should remain an opFon if this scruFny points to such result. Regarding the digital euro: ensuring sovereignty in European payments is a highly strategic objecFve clearly shared by banks, central banks and authoriFes alike. Europe needs to get there fast and in the most cost-efficient way, and all opFons must be explored to that end. This includes a real public-private partnership in an ecosystem that makes room for and best use of all available and developing European-wide soluFons, including the infrastructure that the industry has in place already.

Statement of the General Meeting of the Hungarian Banking Association

The Hungarian Banking Association held its Annual General Meeting earlier today in the recently renovated headquarters of GIRO Zrt. The event was attended by bank CEO’s as well as Government leaders responsible for economic and financial affairs. Balázs Hankó, Minister of Culture and Innovation, highlighted the intermediary role of the banking sector in the field of family support schemes, while Zoltán Kurali, Deputy Governor of the National Bank of Hungary (MNB), stressed the importance of co-operation between MNB and the banking sector.

At the General Meeting, the membership decided to publish the following statement.

A quarter of a century ago, one of the most notable tasks ahead of us was to ensure a smooth transition to Y2K, i.e. to the new millennium in IT. At the time, many thought the 21st century would become the age of robots, characterised by cheap mass production, rapid economic and service industry evolution, the rise of fintech giants and financial stability. Futuristic visions of a complete transformation of financial markets emerged, such as a cashless society, unmanned services, as well as fully digitalised, paperless transactions. A quarter of the 21st century has already passed, with a global financial crisis, a pandemic threatening our health, devastating wars and the most recent protectionist phenomenon. Some of the predictions seem to have come true, others have turned out to be exaggerated. Therefore, the time has come to look back and use this opportunity as a basis for planning a future that also responds to the real challenges of the digital age.

The role of financial markets, with the banking sector being the dominant sector within, has been strengthened over the past 25 years. In this period, the Hungarian banking sector's balance sheet total has grown by 900%, while corporate lending has increased fivefold, including a 50-fold increase in the guaranteed SME lending portfolio. A significant milestone is that we have now reached 10 million bank cards, and assets under management in pension funds have come close to HUF 2 600 billion, and the number of issuing companies on the Budapest Stock Exchange has exceeded 150. Over the past 25 years, domestic banks have paid more than HUF 8 000 billion in taxes and contributions into Hungary’s budget.

Over the past quarter of a century the banking sector has repeatedly demonstrated that, despite the extra burdens, it remains a stable pillar and catalyst for economic growth and recovery in the wake of various crises. In 2025, the key commitments of the Hungarian Banking Association were as follows:

- Banks are restraining from introducing annual inflation-tracking increases in retail account charges,

- Availability of a free basic account,

- Regular awareness-raising about the financially attractive bank account packages available,

- 5% mortgage interest cap for the first green home of young people,

- Fair insurance conditions for the baby loan product,

- Interest rate reduction in the Széchenyi loan programme,

- Installation of ATMs in settlements with more than 2000 inhabitants.

These achievements and voluntary commitments show that the traditional financial sector has played and continues to play a crucial role in growing and running the economy and in carrying the tax burden.

When assessing the economic processes of our time, it is useful to bear in mind that the international situation fundamentally determines and overrides the opportunities Hungary has for developing its open economy. The global world order keeps taking new directions in a matter of moments, with the consequence that economic systems and co-operation will evolve on a different basis and on new foundations. Today's decisions will determine the future for decades to come, which is why it is of paramount importance for the operating environment of the banking sector to ensure international competitiveness and the ability to support the economy.

Cash has always had its usual place and role. Evolution, a transparent economy and the fair taxation of the public have necessitated a rethink of the role of cash. The costliest process is the repeated exchange back and forth between cash and money on the account, as well as keeping cash available for this purpose.

The Digital Citizenship Programme sets out a way forward. Broad use on market terms is also a key to success here. New digital solutions and channels, including electronic financial services, open up new horizons if they are available to market players and their customers at low cost and free of extra taxes and contributions. The universal objective is to make digital services easily accessible and user-friendly. Here again, the successful match is between a Hungarian operator and Hungarian consumers.

Given that financial markets have become fully globalised, the situation in Hungary is assessed from the perspective of the financial systems and relevant actors currently operating. Financial actors in Hungary can be divided into four groups:

- Banks with head offices in Hungary that are owned either to a significant degree or wholly by Hungarian investors. They have a market share of around 50%, as well as a strong local presence, and operate globally from here.

- The interests in Hungary of large European banking operations, which strengthen our embeddedness in the single European financial market. As key players in EU trade and economic co-operation, they play a crucial role in the Hungarian national economy.

- The subsidiaries of banking operations outside Europe, i.e. players of global importance that ensure global financial and economic involvement. Their operations in Hungary are impressive due to their ability to attract capital. Working capital investment by the owner countries is clearly a key factor for the Hungarian economy.

- A significant group of non-bank financial service providers, which complement and support the dynamic operation of the credit market with their specialised activities and services.

They form the basis of the Hungarian Banking Association, and work together to provide the financial resources and connections required for the sustainable operation of the Hungarian economy. The role of Hungarian-based financial service providers must be strengthened, as together they ensure the self-sustaining evolution of the Hungarian economy. They pay taxes in Hungary, and are the most committed towards its citizens and businesses. In order to ensure that customers can continue to be served by domestic financial service providers in the long run, the extra burdens should be lifted from them now.

Quite often, too much is expected of the banking sector both in Hungary and abroad. The most legitimate expectation at national level is to finance Hungarian businesses and families, as the key financial pillar of sustainable development. The current Hungarian funding programmes are wide-ranging. In co-operation with the Government, the central bank and partner organisations, preferential programmes and support channels have been established that are predictable and easily accessible by the entire corporate and retail clientele. In addition to these, financial institutions have also come up with their own programmes, according to their commitments, and this year's commitments have been grouped around 7 topics, as explained above.

To continue and strengthen programmes, despite a volatile regional and global environment, economic operators and the banking sector all need predictability, stability and the cessation of overburdening. To this end, we count on the co-operation and support of the National Assembly, the Ministry of National Economy, the ministries committed to economic development and the National Bank of Hungary. The banking sector is, of course, open to co-operation and supportive of the tasks and objectives of these actors.

At the General Meeting, the election of officers also took place. The new Chair of the Supervisory Board of the Hungarian Banking Association is Peter Roebben (K&H), and its new Members are Krisztina Bogdán (ING) and Bence Katona (MFB).

The event also included the presentation of awards for achievements in the past period.

The Golden Beehive Award was presented to:

- Krisztina Ivanics (Exim)

- Linda Murányi (Erste)

- István C. Szabó (MBH Bank)

- Judit Szűcs (OTP Bank)

- Zsolt Takáts (Raiffeisen Bank)

- István Wimmer (MGYOSZ)

The Golden Beehive Commemorative Plaque was presented to:

- Krisztina Kiss (BEVA)

In addition, 6 people were invited to chair a banking association working group, by way of presenting their letters of assignments as leaders.

Budapest, 9 May 2025 Hungarian Banking Association

11th Hungarian Money Week - PENZ7 (March 3-7, 2025) is a great success all over the country

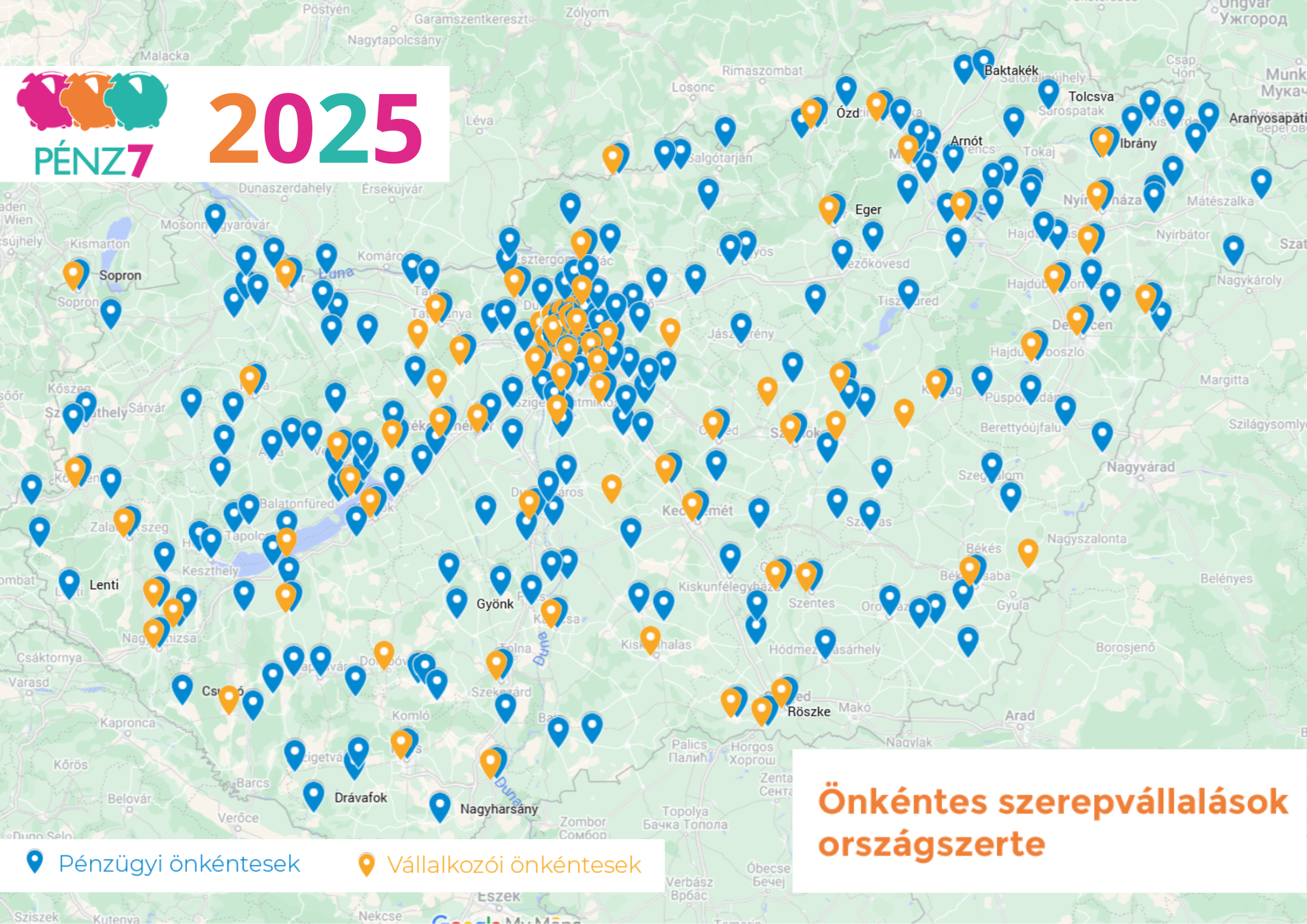

PÉNZ7 in Hungary developing financial awareness, entrepreneurial skills and cybersecurity knowledge, has reached 212,000 students in 1,413 schools across the country, with 15,613 lessons and 715 volunteers this year countrywide.

Watch our film of the HMW 2025: https://youtu.be/TCvNgIiKpFY (English subtitle is available)

Grateful thanks to the volunteers for joining us for the 11th PENZ7 with an outstanding number. Please see here the map representing the residency of the volunteers:

PENZ7 OPENING ceremony, 24 February 2025, Haris Park https://penz7.hu/hir-reszlet.cshtml?hirId=154&pg=0

The official opening event of the PENZ7 happened with the participation of the supporting ministries and the professional organizations.

PENZ7 award was presented to the most active corporate partners: Hungarian State Treasury and Money Museum.

PENZ7 youth adventure book introduction, 4 March 2025, Money Museum https://penz7.hu/hir-reszlet.cshtml?hirId=158

At the launch of the adventure book that forms the backbone of the cybersecurity curriculum, PENZ7 hosted the author of the book and the organisations involved in the development of the curriculum.

Financial Culture Ambassador Award was presented to Ákos Solymos, the author of the cybersecurity adventure book 'Frici, Fülöp és a hackerek', for his work and support on the PENZ7 cybersecurity curriculum.

Institutional award was presented to VISA for its activities in encouraging cyber awareness.

PÉNZ7 Digitális Szimat Kihívás (Digital Sniffing Challenge) https://penz7.hu/penz7-digitalis-szimat-kviz.cshtml

Digital Sniffing Challenge gives you, regardless of age, the opportunity to test your digital security knowledge.

This year renowned influencers tested their knowledge with us again:

https://www.youtube.com/watch?v=0Zh3pIX6Nlk&t=2s

https://www.youtube.com/watch?v=shGgvSOm4NA&t=1s

https://www.youtube.com/watch?v=DYHyWW033wg

Banners created with the influencers can be viewed online and offline countrywide:

PENZ7 supporting programs: https://penz7.hu/kiseroesemenyek.cshtml

PENZ7 classroom education is traditionally enriched with valuable complementary programs. This year, a diverse array of engaging and interactive activities provided additional opportunities for students to deepen their knowledge of PENZ7 topics.

FINTELLIGENCE International Scientific Conference (Miskolc) is one of the recurring programs among the PÉNZ7 events, which this year also offered many experts and excellent presentations: https://www.penz7.hu/hir-reszlet.cshtml?hirId=3

Médiaunió press release: https://mediaunio.hu/veszelyben-a-ferfiak-masfel-ev-alatt-duplajara-nott-az-atvertek-szama/

Grateful thanks to all the contributors, partners and organisers.

Hungarian Banking Association - Communication

PRESS RELEASE

The interest rate on Széchenyi Card investment loans, agricultural investment loans and leasing facilities will be reduced to 3%, and on Széchenyi Card overdrafts, tourism loans and liquidity facilities to 4.5%, in the spirit of burden sharing between the banking sector and KAVOSZ for new contracts signed after 1 March 2025. This will give businesses access to new loans at half the interbank reference rates. This measure can provide the funds required for further growth.

One of the banking sector's best-known core task is to finance sustainable economic development, which it can best ensure in a pure competitive market environment.

In order to be able to invest in operational efficiency and produce higher-quality or less energy-intensive products, businesses typically need substantial amounts of bank credit at prices matching their profit-generation capabilities. In the business sector, micro, small and medium-sized enterprises stand out for the way they span all areas of the economy, playing an essential role in innovation, the employment of a large workforce, flexibility, and in filling market gaps. With this in mind, the various Széchenyi Card credit schemes have become successful and popular among Hungarian micro, small and medium-sized enterprises, with significant Government support. Banks participating in the programme sell these products pursuant to the conditions set out in the KAVOSZ regulations, subject to its pre-screening and intermediation, with the guarantee of Garantiqa Hitelgarancia Zrt. and AVHGA.

In order to ensure that the growth of newly disbursed Széchenyi Card overdrafts, tourism loans, investment loans, agricultural investment loans, liquidity facilities and leasing transactions continues, participating banks and KAVOSZ - in line with the Government's previous measures, i.e. the Demján Sándor Programme, which, since 1 November 2024, has been offering investment-type Széchenyi card loans at a rate starting from 3.5% - will ensure the reduction of interest rates on the above loan products by a uniform 0.5% from 1 March 2025. This reduction can be ensured by participating banks and KAVOSZ by paying 0.4% and 0.1% of the fees, respectively. They are doing this in order to ensure that the credit volumes of relevant businesses can grow. The more favourable pricing offers another opportunity for Hungarian micro, small and medium-sized enterprises to start new investments, boost their efficiency and competitiveness, increase and improve their production and/or reduce their energy consumption.

3 February 2025 Hungarian Banking Association

CYBERSHIELD PRESS BRIEFING - Experts to expect increase in online fraud as Christmas approaches

The upcoming festive season could see an increase in cybercriminal activity and online fraud - as financial, law enforcement and banking experts warned at a press briefing in Budapest.

On 20th November, a press briefing was held about the CyberShield project, which was launched two years ago in cooperation with several organisations (Hungarian Banking Association, MNB, NGM, IM, Hungarian State Treasury, SZTFH, NMHH, NVSZ, NKI, ORFK). At the event, which was well received by the press, one of the points made was that the weakest link is still the individual person, who in most cases voluntarily gives over his or her data to cybercriminals. "Despite the technology and the effortful work of the digital experts working in the background for security, we often learn that people open the 'door' themselves and let the fraudsters in," said Ágnes Sütő, Deputy Secretary General of the Hungarian Banking Association.

They use sophisticated and evolving methods, often taking advantage of their victims' social situation, lack of information, shopping habits or loneliness. Fraudsters do not discriminate between social groups, gender or even age and can target any of us indiscriminately. As fraud increases rapidly during the festive season and other peak shopping periods, prevention and awareness are the main ways to combat against it, which is why the discussion in the ORFK building was highly well-timed and will be repeated at regular intervals to maintain interest and keep up to date with new fraud tricks and thus raise more awareness.

(based on MTI News)

(Participants of the discussion:

Viktor Halász, Police Captain of the Investigation Department of NNI Cybercrime Division of the Rapid Response and Special Police Service

László Sonjic, Senior Advisor, OTP Bank Security Directorate

Orsolya Bíróné Szunai, Coordinator of the Budapest Victim Support Centre

Gabriella Diamantopoulosné Dr. Kenyeres, Head of the Department of Judicial Professional Management of the Ministry of Justice

Ágnes Sütő, Co-Project Manager of CyberShield, Deputy Secretary General of the Hungarian Banking Association

Kristóf Gál, Police Colonel, Head of the Communications Service of the Hungarian National Police Headquarters)

Banking Blood Donor Week celebrates its Jubilee! Sector-wide collaboration has begun for the 5th time

Bankers join forces to raise awareness of charity that heals and saves lives

Budapest, 14 October 2024

The Hungarian Banking Association and representatives of the Hungarian banking sector are organising the Banking Blood Donors' Week for the 5th time. The aim of the event, to which the National Bank of Hungary has been a partner for several years, is to raise awareness of the importance of blood donation among bank employees at sector level and contribute to the production of thousands of blood products through voluntary blood donations.

This year, the now traditional event has been extended to a whole month. The event titled Banking Blood Donor Month 2024 will take place between 8 October and 8 November 2024, with blood donations in 20 banking locations (18 in Budapest and 2 in the countryside). Management and staff members from the National Bank of Hungary (MNB) will also join the event series - expanding the programme into a true cross-sectoral collaboration scheme. The collected blood will be used to make thousands of life-saving blood products to help patients recover.

With the help of the National Blood Transfusion Service, which coordinates the professional tasks of the programme, and the Hungarian Red Cross, the staff members of financial institutions will volunteer to donate blood at banking locations and blood centres in Nyíregyháza and Békéscsaba, in addition to Budapest.

Speaking at the opening event at UniCredit Bank, Csaba Kandrács, Deputy Governor of the National Bank of Hungary (MNB), said ‘MNB has organised 10 blood donations in the past year, where our colleagues gave blood more than 1 100 times - an increase of about 10% year-on-year. This has helped more than 3 000 of our fellow citizens in their recovery, which is clear proof of the power of working together towards a common goal.

In his speech, Barnabás Virág, Deputy Governor of MNB, urged everyone who has the potential to do so, to donate blood, and if possible, more than just once a year. This is not only a contribution to the recovery of our fellow citizens, but such selfless acts of kindness also help us draw attention to the importance of social solidarity and to helping each other. He expressed his gratitude to the donors and his hope that more and more people will follow the banking community’s example.

Sándor Nagy, Medical Director of the National Blood Transfusion Service, thanked the banking sector for its continued and ever-intensifying blood donation efforts.

On the occasion of the 5th anniversary, the National Blood Transfusion Service awarded a certificate to the Hungarian Banking Association in recognition of its outstanding organisation of the event.

On behalf of the Banking Blood Donors' Week, Radovan Jelasity, President of the Banking Association, himself a regular blood donor right at the forefront of the programme with more than 50 donations to date, said thank you to all those who donate blood to support the recovery of others, and expressed his hope that the example set by the banking community will be followed by ever more people. Levente Kovács, Secretary General of the Banking Association, extended banking blood donations from one week to one month to ensure continuity of blood supply. Between 8 October and 8 November, a total of 20 blood donations will take place under this programme at external sites.

In Hungary, five hundred thousand units of blood are needed every year to ensure a safe blood supply, which, in turn, requires around half a million voluntary blood donors. It takes between 1 600 and 1 800 blood donors per day to help maintain a safe blood supply.

Every donation counts - it saves lives.

BACKGROUND:

Members of the banking sector united as one under the auspices of the Hungarian Banking Association during the Covid pandemic, when the GOOD DEED BANK initiative, a joint CSR programme of the banking sector, was created. GOOD DEED BANK embraces initiatives where joint action is required for success, such as

blood donation during the Banking Blood Donor Week. The activities of GOOD DEED BANK were recognised with Mastercard’s ‘Social Initiative 2021’ Special Award. One of the key events organised by GOOD DEED BANK is the Banking Blood Donor Week, during which bankers in Hungary donated thousands of units of blood in recent years to help patients’ recovery. In 2022 and 2023 the programme was extended to two weeks, increasing further to a full month in 2024, also reaching several locations in the countryside.

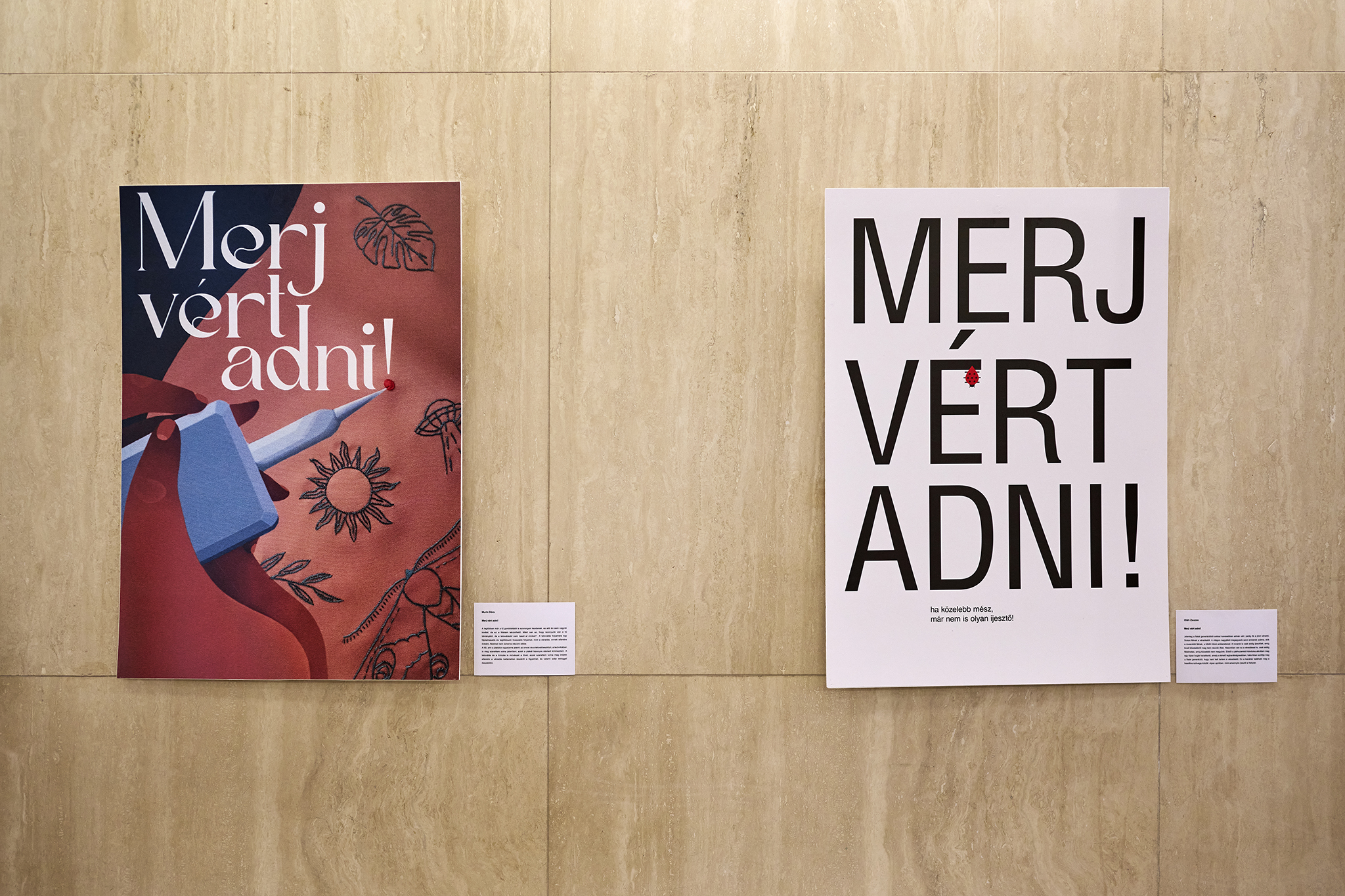

In 2022, as part of the Banking Blood Donors' Week, the Hungarian Banking Association launched a poster design competition to raise awareness of the importance of blood donation through the unique works of young artists from the Moholy-Nagy University of Art and Design. The posters have since helped raise awareness of this social duty.

(Photos: Márk Kiss)

Hungarian Banking Association

14 October 2024

Press release - Apple subscriptions resolved

Budapest, 7 October 2024 – The sector-wide correction of erroneous Apple App Store subscriptions has been completed - no individual customer notifications were needed for resolving the items

The Hungarian Banking Association confirms that the sector-wide correction of duplicate credit card transactions affecting customers of the Apple App Store detected as of the night of 30 September 2024 has been successful.

The Apple error (the multiple booking of specific items) was also experienced in several countries outside Hungary, affecting customers of Hungarian banks through more than 440 000 incorrect transactions. The banking sector, without requesting the filing of individual complaints by affected customers, immediately made significant efforts, in close co-operation with the National Bank of Hungary and the experts of the card companies, to ensure that only legitimate monthly subscription items in force pursuant to their contract with the Apple App Store were debited and charged to their customers.

The Hungarian banking sector, in co-operation with the Mastercard and VISA card companies and with the continued involvement of the National Bank of Hungary, has paid particular attention to ensuring that duplicate items are only debited once.

Thus, for each affected customer in Hungary, the amount of multiple transactions initiated by Apple was deducted only once, which the affected customers can check in their account history.

We are confident that the competent regional and international authorities and bodies will take effective measures to support operators in drawing the correct professional conclusions, and prevent future cases similar to the transactions erroneously initiated in June and this time.

7 October 2024

Hungarian Banking Association

Another Apple case: both MNB and the Hungarian Banking Association are closely monitoring events

Budapest, 1 October 2024 - MNB and the Hungarian Banking Association are taking steps to ensure customer safety and financial market stability in the wake of the most recent Apple-related disruption.

The National Bank of Hungary (MNB) has been informed of repeated payment problems related to Apple. In response, MNB immediately contacted payment service providers and initiated measures aimed at protecting customers. The central bank is closely co-operating with the Hungarian Banking Association, which is in regular work contact with the central bank.

From the very first period of payment problems, it has been clear that most banks are better prepared than before and have taken immediate action to ensure customer safety. According to first, as yet unconfirmed data, this means that far fewer customers are affected by the disruption than in the past.

MNB, whose priority is the stability of financial markets and the safety of its customers, will keep audiences informed.

Budapest, 1 October 2024

Banks are working on the management of duplicate Apple transactions - with the cooperation of the MNB and the card companies

On the night of 30 September 2024, due to a technical error, Apple's App Store duplicated the booking of items that had been previously booked but not yet settled financially. More specifically, in certain cases Apple initiated the collection of the current monthly batch of outstanding subscriptions twice. The technology glitch is reportedly an international problem, affecting cardholders in around 20 countries.

As a result, affected Hungarian cardholders may come across temporary double-bookings on their outstanding subscriptions, which, however, have not been paid a single time.

Hungarian banks, in close co-operation with MNB, are monitoring the items, also taking into account the findings gained from the Apple technology glitch in the summer, and making sure each item is only debited once, in line with the update issued by Apple.

It is recommended that customers also check their account history in a few days’ time to make sure any sums outstanding under the current contract are paid correctly. Should they find any discrepancies, they should report them to the bank's customer service.

Budapest, 1 October 2024 Hungarian Banking Association

New law comes into force against online criminals

On 17 July 2024, the Ministry of Justice (MoJ), the Hungarian National Bank (MNB) and the Hungarian Banking Association (MBSZ) held a press conference to present the new legislation that will enter into force on 1 August 2024 to help combat online criminals effectively.

Minister of Justice Bence Tuzson said that a package of laws to use the law to take action against online criminals was submitted to Parliament this spring at the initiative of the IM, in cooperation with the Ministry of National Economy, the MNB and the MBSZ.

The government's aim with the new package of laws was to speed up the detection of criminal offences.

The MNB expects banks to use a real-time abuse screening system to detect transactions that could be suspected of abuse immediately, before they are executed, across billions of transactions.

More recently, fraudsters are increasingly using targeted phishing, where attackers use public information, including that available on social media, to lure potential victims with personalised messages. This is why it is necessary to look for points in the fight against fraud where it is necessary to strengthen defences," he said.

Levente Kovács, Secretary General of the MBSZ, stressed that it is necessary to be able to recognise cyber fraudsters and their methods, and preventive information has an essential role to play in this.

17 July 2024

Translated with DeepL.com

Press release

Almost all sectors, including the banking sector, have been victims of the war. As well as bearing the market consequences of economic uncertainties, the banking sector has been disciplined and cooperative in bearing the burden of many government measures, and therefore refuses to claim that it has made extra profits in wartime.

The unpredictability of a series of government burdens and measures severely limits the banking sector's lending capacity, international competitiveness and stimulative role.

In addition, the measures published in the Hungarian Gazette on Monday night will further increase the competitive regulatory advantage of fintech providers of cross-border services. The extra profit tax, bank tax and ATM deployment rules originally introduced for two years (2022 and 2023) will not apply to these providers, while the tightening transaction levy rules have been shown to have limited enforcement effect on them.

Meanwhile, the Hungarian banking sector, as the operator of the financial intermediary system, is one of the government's most important partners in the implementation of economic policy: from pandemic management to family policy, from SME financing to digitalisation and infrastructure building, it has proven and continues to prove its commitment every day.

9 July 2024

Translated with DeepL.com

Press release: Apple app store credit card payment problems

Apple's app store erroneously charged large volumes of Hungarian bank card accounts for several hours after 6pm on 26 June 2024.

Thanks to the swift reporting of the erroneous transactions by the affected Hungarian cardholders, the banking sector was informed and, as an intermediary, took immediate action to address the situation.

Accordingly, the banking sector contacted the service provider.

Based on the information available so far, the transactions concerned relate exclusively to past or current subscriptions or purchases with erroneous technical repetition. Purchases or cash withdrawal transactions on physical terminals are not affected.

According to Apple, there are no indications of misuse, no misuse of customer data, no data has been compromised. Apple is accepting related customer inquiries.

Based on their feedback, Apple is in the process of refunding the amounts incorrectly charged due to a technical problem.

27 June 2024

Hungarian Banking Association

Translated with DeepL.com

HELP! I have been a victim of cyber fraud! Who should I contact?

To facilitate effective and professional banking communication with victims of online financial abuse, the Hungarian Banking Association has issued a recommendation to its members

Anyone can become a victim of online fraud, regardless of age, gender, education, financial situation, upbringing, ideology or social status.

Experience has shown that, although some people are at higher risk of becoming victims of online fraud, it is by no means possible to clearly define and/or delineate psychological characteristics that can be identified as a characteristic of the target victim group.

The Hungarian Banking Association has prepared a recommendation in the framework of the CyberShield Programme, with the involvement of the Victim Support Centre of the Ministry of Justice, the Hungarian National Bank and the National Police Headquarters as professional cooperating partners.

The aim of the recommendation is to help bank customer services to communicate professionally and effectively with victims of financial abuse in the online space. It summarises the process for reporting online financial abuse by bank customers and the recommended principles for customer service communication to bank staff.

The technical material produced serves to harmonise two different aspects: on the one hand, to ensure that the bank's customer service is empathetic and compassionate in its communication with victims of online financial abuse. On the other hand, to accurately record the incidents reported by the victims, which the bank needs to investigate and then take the necessary measures to prevent further damage.

The full content of the recommendation is not made public because the technical details would help fraudsters to map out their customer handling processes, so that they could even more convincingly present themselves as "banking experts".

In case of abuse, it is essential that the customer should report the incident to the bank immediately! This is the REPORT. The most common form of reporting is to call the call centre/customer service, less often customers visit the branch in person. After contacting the bank, it is important that the REPORT is also made to the Police.

The technical material has been produced at the initiative of the Ministry of Justice (MoJ) in cooperation with the CyberShield Programme, to help banks communicate professionally and effectively with victims of online fraud.

IM's victim support service is linked to the CyberShield programme in several ways. In addition to consumer protection and victim assistance, the work of the recently formed legal sub-group also relies on the work of the Ministry. The experience gained since the IM joined the project confirms both the need and the usefulness of its participation in the project," said Dr Gabriella Diamantopoulos, Head of the Department of Justice Professional Management at the Ministry of Justice (MoJ). She said that the main focus is on communication with victims of online financial abuse, and that the programme is also trying to help with statistical data and, of course, legislative changes to reduce fraud.

In her presentation, Dr Julianna Dávidné Dr. Hidvégi, clinical psychologist, spoke about how bank counsellors can prevent customers who have become victims of online fraud from becoming secondary victims.

She stressed that it is important to prevent bank counsellors from being unprepared for the emotional reactions of victims of online fraud and to avoid, as far as possible, the client being victimised. Once an online fraud has occurred, it cannot be undone. However, the ability to become an active part of society again depends on the personal choice of the victim.

The press conference was hosted by OTP Bank. Six months ago, the bank decided to set up a special call centre for fraud victims at the Bank Security Directorate. As part of the restructuring, the bank's Call Centre has been replaced by a dedicated team to deal with victims. "The experience of the last six months shows that we have made the right decision to ensure that customers who have been victims of fraud can quickly reach us on the dedicated line. Today, we are receiving more and more calls where our customers ask for advice on how to prevent fraud, but recently we also had a case where fraudsters called our customer who became suspicious and called our Anti-Fraud Call Center, so with the guidance of our colleague they were able to prevent a remote access program from being downloaded to the customer's device," said Gábor Bucsek, Head of OTP Bank's Bank Security Directorate. OTP Bank has recently given its customers a new tool to fight fraudsters, introducing a transfer limit on 8 May, which most mobile bank users have already set much lower than the original HUF 1 million limit in the weeks since its launch.

The daily transfer limit is being introduced and successfully used by an increasing number of institutions in the banking sector, in line with the relevant MNB recommendation. As a bank customer, it is worthwhile to check it out and adapt your daily limit to your own needs based on your financial habits.

depends on.

The police have also sent a message of war to the perpetrators and have set a new basis for investigating this type of case.

The police's commitment to fighting cybercrime is also reflected in the numbers, with a 23% reduction in online fraud in the first quarter of 2024 compared to the first quarter of 2023.

Since 1 January 2023, investigators have arrested and questioned 688 people as suspects and identified more than 350 people as suspects.

In terms of their role, 48 persons are in managerial positions, 456 are stewards and 93 are organisers at different levels of the criminal organisation hierarchy. Since the beginning of last year, 105 arrests and 9 criminal supervision orders have been issued by the courts. Currently 56 persons are under arrest.

The perpetrators have caused more than HUF 30 billion in damages to nearly 17,000 people.

The units are paying special attention to the detection of fraudulent call centres, one possible way of which is to identify the IT system that enables the calls. The case was investigated by police at five locations and three people were handcuffed.

Proceedings against them for fraudulent use of an information system to cause significant damage to business are still ongoing.

Although criminals with the latest IT skills, banking, sociology and psychology are unscrupulous in their attempts to take money and personal details from unsuspecting people, the police are doing their utmost to prevent this from happening again.

www.kiberpajzs.hu

- End of the press release -

As background:

CyberShield

In order to prevent and curb financial abuse in the digital space, the Hungarian National Bank, the Hungarian Banking Association, the National Media and Infocommunications Authority, the National Cyber Defence Institute of the National Security Service and the National Police Headquarters signed an agreement called "CyberShield" in November 2022. The cooperation was later joined by the Ministry of Justice, the Ministry of Economic Development, the Hungarian State Treasury, the Regulated Activities Supervisory Authority and the National Defence Service.

The aim of the CyberShield programme is for customers, together with public authorities and market players, to create a "bulletproof" defence against digital criminals. Under the KiberShield project, a wide range of coordinated communication campaigns on cybersecurity risks and ways to protect against them are being conducted by institutions and market players, and the Media Union Foundation as a communication partner (kiberpajzs.hu, akulcstevagy.hu).

But CyberShield is more than just communication. Throughout the year, intensive cooperation will take place to analyse and further develop cybersecurity processes in the public authorities and the market. In addition, there is an ongoing exchange of professional knowledge and best practices at national and international level to achieve stronger and more effective financial cyber defences.

Translation: DeepL

Communiqué issued by the General Meeting of the Hungarian Banking Associatione General Meeting of the Hungarian Banking Association

Founded 35 years ago, the Hungarian Banking Association held its anniversary celebratory conference and General Meeting today, which was attended by, beside banks’ executives, government leaders responsible for the economy and finances, as well as 11 foreign banking association delegates. Márton Nagy, Minister for National Economy, informed participants about the as-is status the Hungarian economy. István Nagy, Minister for Agriculture, spoke about the best way of ensuring liquidity for businesses and sustaining the competitiveness of production under the current, more challenging circumstances; while Barnabás Virág, Deputy Governor of MNB, addressed the current challenges of monetary policy. A cooperation agreement between the Ministry of Agriculture and the Hungarian Banking Association was signed.

At the General Meeting, the members decided to publish the following communiqué.

The wars in our neighbourhood and in the world constantly pose a challenge to democratic countries, including the Member States of the European Union. War evolvements cause uncertainty in energy prices and supply chains, the rearrangement of foreign trade flows due to the sanctions, the sense of escalation of war and the financial expenditures required for self-defence constantly hinder predictable economic development opportunities. Hungary is particularly sensitive to this, as its opportunities are significantly limited by the foreign economic environment due to its highly concentrated foreign market relations and small and open economy.

In recent decades, the open economy based spectacular development has been ensured by the adoption of market rationale. This demonstrates that the banking sector can operate most effectively and contribute to economic development on a market basis. That is why we support market-based development, that is why we are committed to financing investments in Hungary and Hungarian investments abroad And that is why we fight against market-distorting effects such as the sectoral surtax resulting in over-taxation, the interest rate cap and over-bureaucratized rules, as well as such legal framework that regulates the same activity in a different way and gives an advantage to the banks' new competitors. Today, these are the main obstacles to increasing European and regional competitiveness.

The Ministry of Finance contributes to the stabilization of the budget and the reduction of high inflation through fiscal rigour, while the Magyar Nemzeti Bank contributes through the central bank's interest rate policy. And the Ministry for National Economy is trying to give a new boost to the Hungarian economy by increasing investments. We can responsibly welcome actions to curb inflation, the targeted interest rate-subsidized credit facilities and decisions to support market processes, all of which contribute to the rapid recovery of the economy.

Digitalization is penetrating banking processes more and more deeply. On the one hand, this means more competitive, more customer-friendly and, ultimately, lower-cost services. In-depth digitalization helps electronic financial solutions popular with customers to gain ground. Digitalization is also helping to displace the expensive cash that fuels the grey economy and leads to the emergence of new social norms. Another effect of digitalization is the emergence of cyber crime. Cybercrime is a criminal category that law enforcement agencies are responsible for eradicating. In addition to the banks' very significant preventive IT efforts, customers can be protected by providing information and developing their financial literacy. The Cyber Shield program, organized jointly with the MNB, government agencies and other partners, and the continuous awareness-raising media appearances implemented together with the Media Union Foundation contribute to this. This can help reduce the number of victims of cybercrime, but the ultimate solution will be successful crime detection.

At the anniversary event, recognitions were also given based on the results of the last year/decade.

The Golden Beehive Award honour was conferred on:

- Sébastien de Brouwer (EBF)

- Gergely Fábián (NGM)

- Judit Gondos (PM)

- Ágnes Hornung (KIM)

- Anna Kósa (Erste)

- Péter Kovács (MagNet)

- István Nagy (AM)

- Ákos Tisza-Papp (MBH)

- István Tresó (K&H)

- Katalin Werny-György (OTP)

The Golden Beehive Medallion Award was conferred on:

- Tibor Pataki (MNB)

- Katalin Szenes (ÓE)

The Polish delegation awarded the Copernicus Medal to Levente Kovács (Hungarian Banking Association) for his work in the development of the banking sector.

In addition, 8 persons were assigned for the positions of Chairman of Banking Association Working Group and chief advisor by handing over their credentials.

Budapest, 10 May 2024 Hungarian Banking Association

Visit of the Banking Associations of Croatian, Serbian and Slovenian Countries

On 11-12 April 2024, the Hungarian Banking Association hosted the members of the Boards and Secretaries General of the Croatian, Slovenian and Serbian banking associations. The two-day event provided an opportunity to discuss competitiveness, digitalisation and fraud prevention.

On 12 April 2024, Mr Gergely Fábián, State Secretary for Industrial Policy and Technology of the Ministry of National Economy, gave a presentation entitled "The current state of the Hungarian economy". From the Hungarian National Bank, Anikó Szombati, Managing Director, summarised the digitalisation situation of the Hungarian banking sector. Finally, Lajos Bartha, Managing Director of the Hungarian National Bank, gave an update on cyber protection and fraud prevention.

Translated with DeepL.com

Hungarian Money Week (PÉNZ7) celebrates its anniversary!

OECD Secretary General Mathias Cormann has welcomed the Hungarian PÉNZ7 in a video message, highlighting Hungary's commitment to developing financial awareness and knowledge among young people.The 10th PÉNZ7 kicked off on 4 March 2024, with thousands of schools across the country hosting a week of unconventional lessons supported by expert volunteers. This school year, the focus is on "Financial Life Lessons" in finance and "Think and Do" in entrepreneurship.

More than 200,000 students in 1,250 schools across the country are already taking part in the programme, which aims to develop financial awareness and entrepreneurial skills through 15,000 extraordinary lessons, with the help of 650 volunteers. In 2015, Hungary joined the European Money Week initiative, which is taking place simultaneously in around 35 countries across Europe, as a founding member, and we have also been a key participant in the global Global Money Week programme organised by the OECD/INFE for several years.

Hungarian PÉNZ7 2024 will take place from 4 to 8 March across the country.

The Ministry of the Interior is the project leader, while the Ministry of National Economy, the Ministry of Finance, the Hungarian Banking Association, the Pénziránytű Foundation and the Junior Achievement Hungary Foundation are professional partners of the week - the partner organisations consider their mission to educate the future generation in financial and economic matters, to shape their entrepreneurial spirit and to manage financial situations in everyday life in a conscious way.

This school year, in view of the anniversary of PÉNZ7, the organisers have prepared a comprehensive theme entitled "Financial Life Lessons". Schools can choose from a range of different thematic packages and corresponding online games. The digital curricula of PÉNZ7, which develops entrepreneurial skills, have also been further expanded.

To help them prepare, all the learning materials from previous school years (including sample videos, e-learning materials and webinars) are available at www.penz7.hu. Whether it is in class, technology and engineering, maths or history, students can learn the basics of finance and management in an interactive and experiential way.

The PÉNZ7 programmes are further enriched by the possibility for students to participate in interesting competitions and contests, and for schools to host financial and entrepreneurial volunteers.

The PÉNZ7 programme also supports the implementation of the objectives of the National Strategy for Financial Awareness adopted by the Government in 2017 and the SME Strategy 2019-2030 (Strategy for the Strengthening of Hungarian Micro, Small and Medium Enterprises), which aims to develop Hungarian micro, small and medium-sized enterprises.

The detailed programme of the week is available at www.penz7.hu.

(Translateted by: DeepL)

Active bank lending is a key to economic growth

The banking sector has a key role to play in supplying the credit required for sustainable economic growth. Active lending is the primary task of the banking sector responsible for this, in which the Hungarian Government is seen as a partner. Co-operation is demonstrated by on-going dialogue, predictability and agreements that are honoured. The banking sector has finally been able to increase the real value of its capital from the P/L of recent times, which is an essential prerequisite for the credit expansion required for rebuilding the economy.

In recent days, at the initiative of the Ministry of National Economy, we have reviewed current challenges to economic development and the macroeconomic environment. From the discussions, we have come to the conclusion that even in a rapidly declining interest rate environment, the current level of lending rates is a possible temporary constraint to credit expansion. Accepting the proposal of the Ministry of National Economy, the Hungarian Banking Association draws the attention of its membership, in a supportive manner, to the campaign aimed at boosting corporate lending. During the campaign, the interest rate premium above BUBOR on market-term corporate loans contracted between 1 February and 30 April 2024 and, in the case of investment loans, disbursed this year, can be waived by individual lenders for a period of 6 months. Commercial banks may accept this invitation on a voluntary basis, at their own discretion, in line with their own business policy objectives. The Hungarian Banking Association is confident that the reduction in corporate lending rates will provide a boost to Hungarian companies open to investment to start and complete their investments.

The Hungarian Banking Association also welcomes the end of the corporate interest rate freeze introduced in 2022. We are convinced that the discontinuation of market distorting measures, the reduction of significant burdens imposed upon the sector and the provision of the right conditions for market competition will result in better prices and conditions for customers, including companies that are implementing key investments and creating jobs – both being keys to recovery. In this we count on the support of the Government, the Ministry of National Economy, Partner Ministries and the central bank.

Budapest, 30 January 2024 Hungarian Banking Association

Continuation of CyberShield - Strengthened collaboration protects our money in cyberspace

Budapest, November 15, 2023 – The first year of the CyberShield program, which enhances digital security, has been realized through unprecedented collaboration. The experiences of the cooperation were summarized at a conference, and the continuation of the CyberShield program was announced.

Fake bank calls, deceptive online commercial offers, caller ID spoofing, callback phone scams (wangiri), phishing emails – these are just a few of the deceptive actions we encounter every day in the digital space. In order to prevent and reduce financial abuses committed in the digital realm, the Hungarian National Bank, the Hungarian Banking Association, the National Media and Infocommunications Authority, the National Cyber Security Institute of the National Security Service, and the National Police Headquarters entered into an agreement called "CyberShield" in November 2022. Later, the Ministry of Economic Development, the Ministry of Justice, the Hungarian State Treasury, and the Regulatory Activities Supervisory Authority also joined the collaboration.

The goal of the CyberShield program is for customers, authorities, and market players to collectively create "bulletproof" protection against digital criminals. Within the framework of the CyberShield project, comprehensive and coordinated communication campaigns are conducted by institutions and market players to present cyber security risks and defense options. The Media Union Foundation is also a communication partner (kiberpajzs.hu, akulcstevagy.hu).

However, CyberShield is more than just communication. Throughout the year, there is intensive collaboration to analyze and enhance cybersecurity regulatory and market processes. Additionally, continuous domestic and international knowledge sharing and gathering of best practices are ongoing to achieve stronger and more effective financial cyber defense.

Following the summary of the experiences of the first year of collaboration signed until December 31, 2023, the partners announced the continuation of the program.

Dr. András Koltay, the President of the National Media and Infocommunications Authority (NMHH), emphasized that two significant topics affected the Authority in the first year of CyberShield: interventions by service providers to hinder caller ID spoofing and the review of regulatory opportunities related to these interventions, and the investigation of frauds that harm users of financial services using the names and branding of postal service providers. "We have made significant progress in these areas, both in technological and regulatory issues. Service provider interventions and the development of new regulatory frameworks have significantly contributed to strengthening the cybersecurity environment. The development of service provider interventions to hinder caller ID spoofing and the associated regulatory opportunities is currently one of our most important professional tasks," he added. He stated that NMHH is committed to continuing the work started to closely collaborate with its partners for further strengthening the security of the online space.

In his speech, Dr. Csaba Kandrács, Deputy Governor of the Hungarian National Bank (MNB), stated that the Hungarian banking and payment system is secure, but further action is needed since 72 percent of financial abuses are now due to phishing attacks against customers. Therefore, the CyberShield customer education program must be effectively continued in 2024. It is a significant success that the kiberpajzs.hu website, renewed in April this year, has been visited by 171,000 consumers in recent months, with two-thirds of them being aged 55 and older, belonging to one of the vulnerable groups.

MNB recently issued an anti-fraud recommendation focusing on the handling of frauds in banks, examined abuses related to online loan applications, and is actively participating in EU and national legislation (e.g., establishing a hotline between the police and banks). As the owner of GIRO, which processes payments, MNB is building a Central Abuse Monitoring System that will help banks prevent abuses on interbank networks.

"The establishment of rules and practices for fraud prevention and management aims at protecting consumers and restoring and increasing trust in financial services. We should handle our finances with attention and in a calm environment whenever possible. The basic principle is that if something goes wrong, we must act immediately: informing our financial service provider, our bank, and aiding the work of law enforcement agencies immediately helps if we take steps there as well," emphasized Dr. Anikó Túri, Administrative State Secretary of the Ministry of Economic Development.

János Balogh, Major General and National Police Chief, added that the police are at the forefront of the CyberShield initiative, as the number of offenses committed in the online space is increasing. He drew attention at the conference that neither the National Police Chief nor police leaders send payment demands, so if someone receives an email of this nature, they should be suspicious of an attempt to deceive. He also pointed out that the reimbursement of damages caused by crimes is a cornerstone of the police's crime-fighting strategy, which applies to online frauds as well.

He informed the attendees that in the fall of 2023, the National Police initiated the Matrix Project, in which 300 cyber investigators nationwide work to coordinate and uncover online crimes. There are already results from the first month of detective work, with arrests and charges made, and several offenders have been placed in custody. The police have a good international network, so it is likely that foreign offenders will also be identified. As a closing thought, he sent a message to the perpetrators: "Don't relax, because we will find them!"

Dr. Marcell Biró, President of the Regulatory Activities Supervisory Authority, emphasized in his speech at the conference: "In Hungary, our Authority is responsible for supervising the cybersecurity certification of digital products. Initially, we are preparing the certification rules for so-called IoT products (digital products connected to a digital network). We will coordinate the draft regulation with the European Commission in mid-November. It is necessary to conduct the technical notification procedure, which is expected to take a minimum of 3 months. The introduction, providing adequate preparation time, is expected by mid-2024, making Hungary the first EU member state to have the complete legal regulatory environment necessary for cyber certification."

Dr. Róbert Répássy, Parliamentary State Secretary of the Ministry of Justice, stated that the ministry is connected to cybersecurity in two ways: firstly, through raising awareness of consumer protection and taking decisive consumer protection authority action, and secondly, through aiding victims of crimes and offenses against property. He added that education targeting the general public is ongoing, and much work still lies ahead. Unfortunately, due to continuously changing and increasingly sophisticated methods, even people who have already informed themselves on the topic are successfully deceived by cybercriminals, sometimes losing millions of forints. Active and regular information and education are needed due to these constantly evolving and more sophisticated methods. Therefore, the Ministry of Justice will provide all necessary assistance to support the CyberShield program and to convey its messages to everyone.

Major General Csaba Kiss, Director-General of the National Security Service, emphasized that their goal is to achieve high-level cybersecurity, particularly focusing on government agencies and vital system elements. In addition to this, their main mission is to help people defend themselves against abuses in cyberspace and to support their preparation for future cybersecurity challenges. He emphasized that they are pleased to participate in the CyberShield collaboration and are committed to actively supporting its future activities.

Bugár Csaba, President of the Hungarian State Treasury, stated that due to the importance of the matter, the Treasury is an active member of the CyberShield collaboration. Its goal is to increase customers' awareness of cybersecurity and protect savings on securities accounts. To achieve this, new security features aimed at preventing phishing incidents will be integrated into the WebKincstár and MobilKincstár interfaces in the near future.

In his address, Levente Kovács highlighted that in the digital age, there are no longer telegram carriers, and bank robbers have disappeared. Instead, new risks have emerged – the scammers of cyberspace. The most effective way to defend against them is through collaboration and the CyberShield program. As a co-founder, the Hungarian Banking Association confirms its commitment to the continuation of the CyberShield program and will organize and coordinate extensive professional collaboration with the same enthusiasm in the future.

For more details about the program: kiberpajzs.hu

Joint press release of the CyberShield collaboration members.

Working together to improve students' financial and entrepreneurial skills (translation coming soon)

Today, six organisations have signed a cooperation agreement to develop students' financial and entrepreneurial skills in the framework of the MONEY7 week in the 2023/2024 school year.

The document on the implementation of the 10th PÉNZ7 was signed by the Ministry of the Interior as the project promoter, the Ministry of Economic Development, the Ministry of Finance, the Hungarian Banking Association, the Pénziránytű Foundation and the Junior Achievement Hungary Foundation as the cooperating professional partners of PÉNZ7.

Next spring, between 4-8 March 2024, PÉNZ7 will be held for the tenth time. Since its inception, the Hungarian PÉNZ7 programme has also been a participant in European Money Week, which takes place simultaneously in around 35 countries, and since 2016, in Global Money Week. Last year, over 145,000 students from 1,100 schools in Hungary took part.

In view of the Money7 jubilee, this school year the organisers are preparing a comprehensive theme entitled "Life Lessons in Finance". Schools will be able to choose from a range of different thematic packages and corresponding online games.

The cooperation agreement was signed on 8 November 2023 at the Ministry of Economic Development by Dr. Zoltán Maruzsa Zoltán, State Secretary for Education (BM), Dr. Anikó Túri, State Secretary for Public Administration (GFM), Judit Gondos, State Secretary for Public Administration (PM), Eszter Hergár, Chair of the Board of Trustees (Pénziránytű Foundation), Levente Kovács, Secretary General (Hungarian Banking Association) and Orsolya Musákné Gergely, Managing Director (JAM).

Translated with Deepl.com

In memory of Lászlóné Béke